by Shadra Bruce

Living in debt has become the norm. Credit has involved into one of the most profitable industries in the country. Credit card companies in particular prey on those who are least likely to be able to repay their debts as well as those who feel they must have what they cannot afford.

There is no doubt that accumulating credit debt is the enemy of financial health. Creditors make it possible to live above our means, spend what we don’t have, and create an illusion of wealth.

The path to true financial health begins with seeing through the illusion of credit.

- We have to start changing the way we look at how we accumulate stuff. We must begin changing the reality of wealth in America.

- We can’t lease BMWs when all we can afford is Hyundais

- We can’t buy 50-inch big screen TVs with credit cards when all we can afford is 22-inch

- We can’t charge $8,000 vacations and hope we get them paid off before we plan the next one

- We have to change the way we live.

Credit debt is the enemy of financial health.

Credit debt is the enemy of financial health.

The items you have hold no value because of the money you now owe (and the interest you now pay) to have them. You might have only charged $4,000 on your credit card, but if you make minimum payments on a card with 18% interest, you will end up paying $25,010 in interest – and it will take you 40 years to do so.

It is impossible to be financially healthy when you rely on credit. The steadily increasing rate of debt is part of why we were unable to survive the housing collapse and the recession.

To truly gain financial health, credit debt can’t be a part of your life. Any purchase is less inexpensive when it is done without loans or credit, avoiding the interest rates and fees. By living within your means rather than above them, you will be in a position to create financial health.

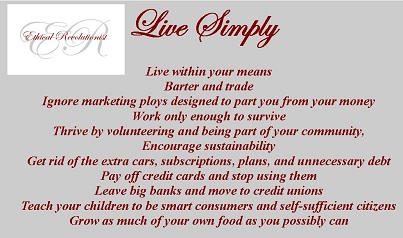

- Live simply

- Live within your means

- Barter and trade

- Ignore marketing ploys designed to part you from your money and make you want things you don’t need

- Work only enough to survive; thrive by volunteering, being part of your community, and encouraging sustainability

- Get rid of the extra cars, cable subscriptions, unlimited cell phone plans, and unnecessary debt

- Pay off your credit cards and stop using them unless you pay off immediately what you charge

- Leave big banks and move to credit unions

- Donate extra money to Rolling Jubilee to help others

- Teach your children to be smart consumers and self-sufficient citizens

- Grow as much of your own food as you possibly can